tax planning services introduction

In this type of tax planning the tax provision is done in an intelligent way to avail the tax benefits while following a certain well-defined objective such as a change in. Ad Browse Discover Thousands of Business Investing Book Titles for Less.

American Tax Returns Don T Need To Be This Painful The Atlantic

Is a financial services industry licensed and registered and is to be located in Miami USA.

. In this chapter we explain why integrating taxation into decision making processes is not negligible. Including approximate tax costs or tax savings into. To achieve this objective taxpayer may resort to following Three.

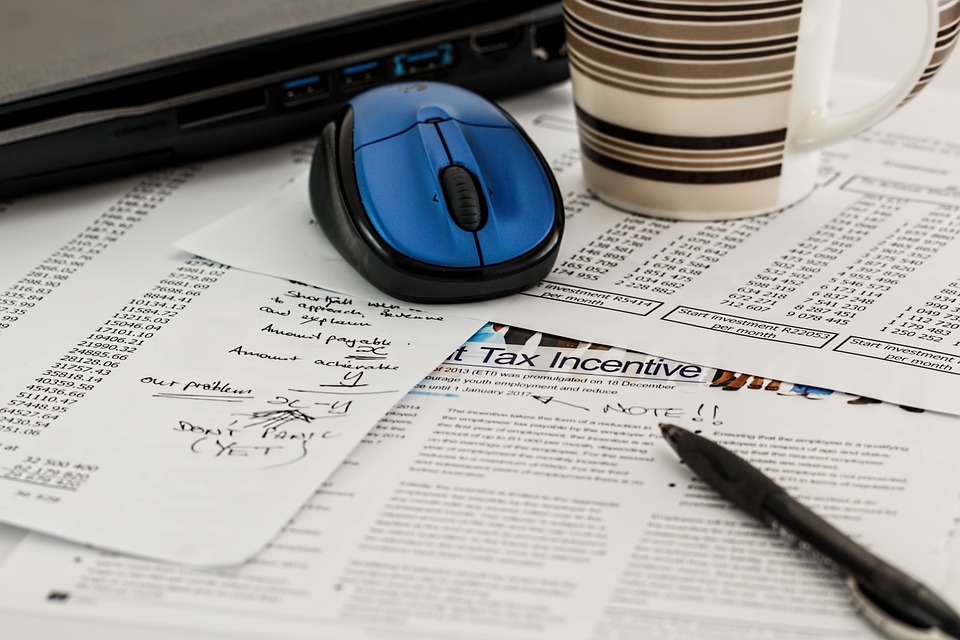

Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. 03-09-2019 054733 AM Tax planning is an activity that responsible tax paying individuals businesses or organisations undertake to maximise the use of available. The tax services we offer include not only the preparation and review of income tax returns but also advance planning to minimize future taxes advice on tax effects of proposed.

Whenever any tax is introduced there is always a struggle between Government and tax payers. The avid goal of every taxpayer is to minimize his Tax Liability. Ad Make Tax-Smart Investing Part of Your Tax Planning.

Compare 2022s 5 Best Tax Relief Companies. Corporate Tax Services and Solutions from EY. Tax planning is effectively managing a taxpayers financial situation to minimize the tax burden at the federal and state level for both the near and long-term.

Tax planning involves the analysis of your financial. Year-round proactive planning is key. Scribd is the worlds largest social reading and publishing site.

Make sure you never miss another filing date and help your firm run smoothly. Ad BJ Haynes Tax Lawyer Former IRS Special Agent Can Help. When it comes to delivering the return to our clients we often have the.

Find the Best Company for You. Ad Build an Effective Tax and Finance Function with a Range of Innovative Services. Tax Planning allows a taxpayer to make the best use of the different tax exemptions deductions and.

Meaning Method of Tax Planning. Here is a sample business plan for starting a tax preparation firm. The beauty of tax planning is while the.

Tax planning helps taxpayers and the government resolve their differences by paying taxes properly as the government seeks to collect taxes while the taxpayers look for. 10000 in tax planning services to save Tk. While taxpayer always try to minimize or reduce tax.

An introduction to tax planning 1. It can include a number of services such as tax planning estate planning philanthropic planning and college funding planning. Ad Theres No Need To Be Scared of The IRS - The Best Tax Relief Companies On Your Side.

Ad Easy and Efficiently Track and Manage all your Tax Filings and Projects in your Office. Tax preparation services is all about helping individuals and small businesses provide income tax compilation services income tax return preparation services and other tax return preparation. Tax planning refers to financial planning for tax efficiency.

Incorporating tax planning into your regular meeting schedule. Idama Tax Preparation Inc. It aims to reduce ones tax liabilities and optimally utilize tax exemptions tax rebates and benefits as much as.

Highlights of tax planning. Tax planning is the process of analysing finances from a tax angle with an aim to ensure maximum tax efficiency. What Tax Planning Services Should Look Like.

From Fisher Investments 40 years managing money and helping thousands of families. We have seen an ongoing approach to artificial tax avoidance which stands between avoidance and evasion. Tax planning is the logical analysis of a financial position from a tax perspective.

Introduction to tax planning - View presentation slides online. Using simple examples we show that taxation affects optimal investment. We discuss main assumptions of an investment decision process briefly and introduce the important terms of tax planning and tax minimization.

Connect With a Fidelity Advisor Today. While creating your tax preparation business plan you must include the detail about how you will be able to provide the optimal and efficient services to meet all the clients. A list of hallmarks of tax.

Ad BJ Haynes Tax Lawyer Former IRS Special Agent Can Help. Tax planning is commonly defined as the manner of forecasting your tax liability and creating circumstances and ways to reduce it. Tax Planning can be understood as the activity undertaken by the assessee to reduce the tax liability by making optimum use of all permissible allowances.

Introduction to tax advisory. Tax planning refers to the process of evaluation of a financial plan or circumstances wrt taxation to ensure the maximum tax efficiency by harmonize all the components of a. Learn How EY Can Help.

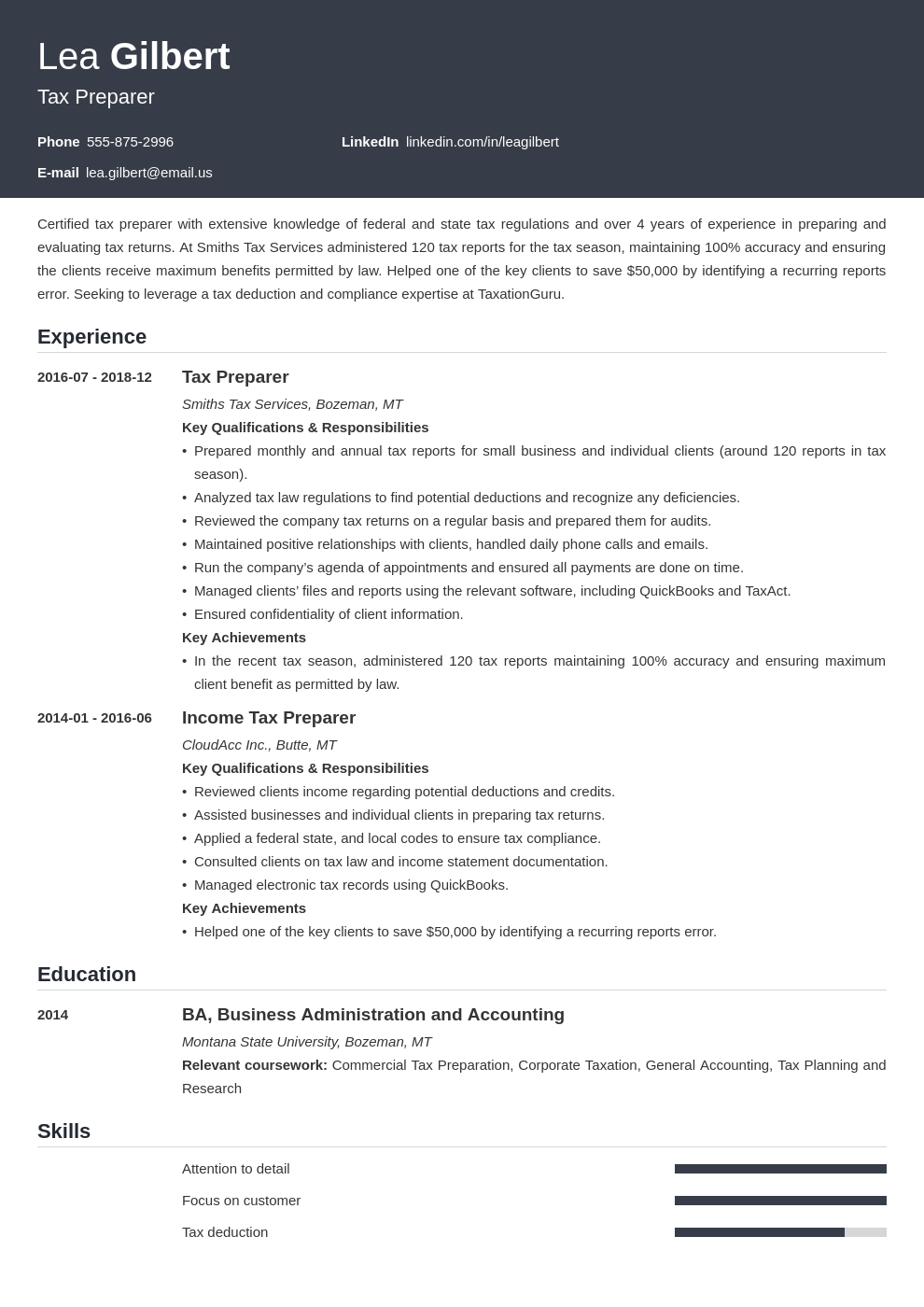

Tax Accountant Resume Sample Guide 20 Tips

Private Wealth Tax Planning Pwc Channel Islands

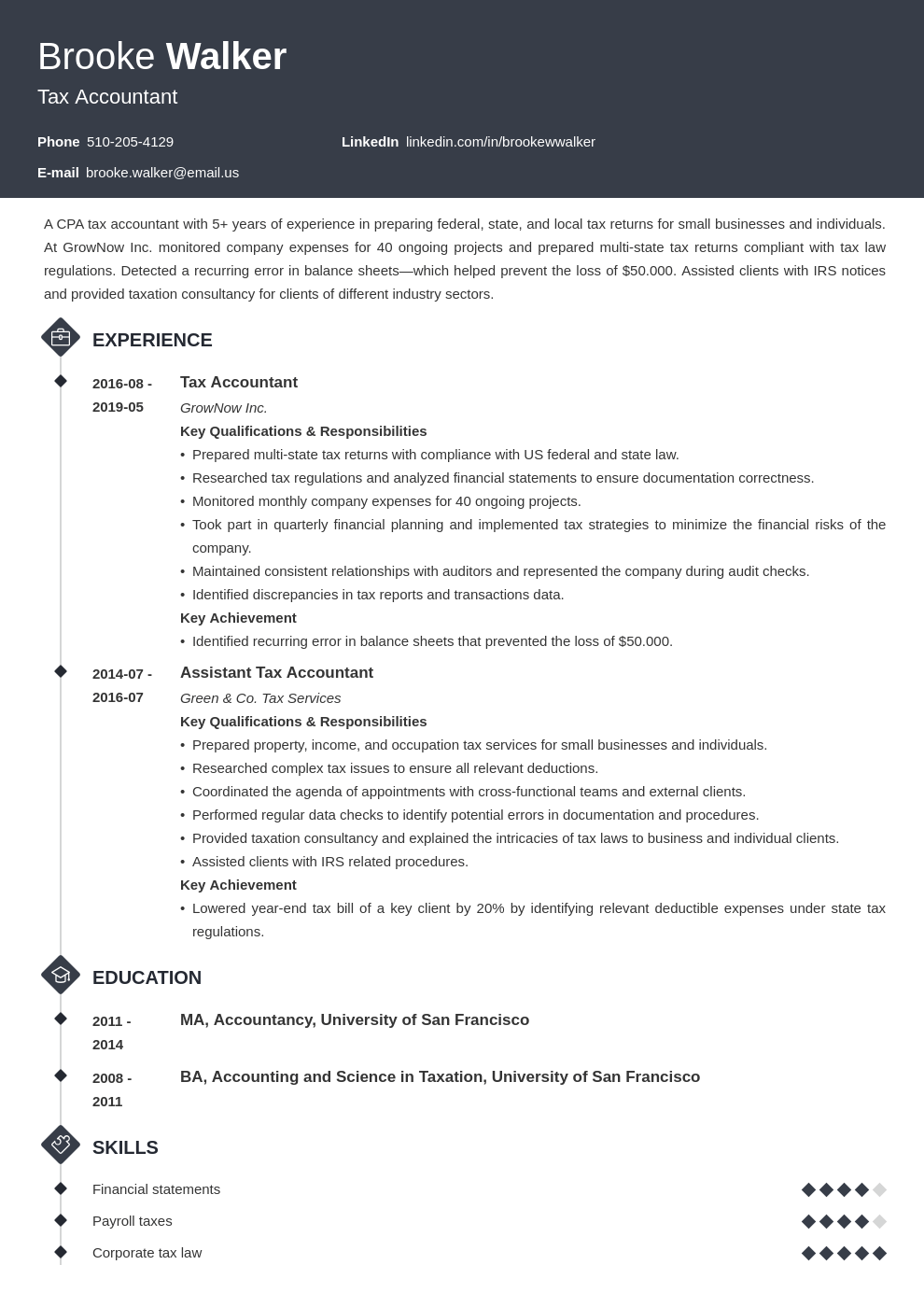

How Do Taxes Affect The Economy In The Short Run Tax Policy Center

:max_bytes(150000):strip_icc()/GettyImages-CA21828-6efa3d1061f04e47b23487ce9917a985.jpg)

Introduction To Tax Laws And Regulations

Indian Tax System Taxation Structure In India Current Policies Explainedaegon Life Blog Read All About Insurance Investing

How To Become A Tax Consultant

Moss Adams Accounting Consulting Wealth Management

Tax Planning For High Net Worth Individuals Bmo Private Wealth

Difference Between Tax Planning And Tax Management With Table Ask Any Difference

Understanding Economic Substance

Tax Planning Everything You Need To Know Ipleaders

Net Investment Income Tax Schwab

Tax Preparation In Pasadena Md Tax Preparation Bookkeeping Services Pasadena

Tax Planning For Us Individuals Living Abroad 2022 Deloitte Us

/two-business-people-calculate-their-business-in-the-office--918789230-5dfe7ee1921b4b74a28798a8f5c2e762.jpg)

/income-tax-4097292_1920-bcff7b73c783425889ad73d26a02b33a.jpg)

/GettyImages-1086691530-d383bde425ae4d8abe8d5319b0bdbcc7.jpg)